My Plan to get to £2,000,000 invested

Because if you fail to plan, you are planning to fail.

In my first post, I made the outlandish claim that I think I need £2,000,000 to retire early and achieve the lifestyle I want. In this post, I will outline as transparently as I can how my saving is currently going, what financial vehicles I am using to optimise for tax efficiency and the risks I have identified that could impact me from achieving my goal.

Current Savings

Currently I have ~£390,0000 saved. This consists of:

£50,000 in premium bonds.

£22,000 in a Marcus savings account.

£150,000 in an ISA (iWeb & Vanguard).

£50,000 in an GIA (Freetrade).

£110,000 across various pension schemes.

£8,000 of Cryptocurrencies (lol, remember crypto?)

I also have around ~£200k of house equity, but I do not count this since selling my house and “releasing equity” does not form part of my plans. I also assume in my plans that I will not receive the UK state pension, since I predict by the time I am old enough to draw it it will be means tested and I won’t get any ( I have no evidence for this, however its worth reading pages such as this and forming your own view).

The composition of my savings therefore currently look as follows:

This is pretty cash heavy currently. This is because we are considering upsizing our house and even though we have a large amount of equity in our current home that we hope would more than cover the deposit, interest rates are so high at the moment that we want to be able to throw some extra cash in to bring the LTV down if it helps us secure a substantially better deal. If not, I’ll throw some of it in my ISA on the first day of the new tax year and put the rest in my GIA.

Income Streams

I currently have 2 main income streams. My full time PAYEE role and consulting part-time.

My full time role is by far my major source of income and is currently the only way I am drawing income. For this, I receive £150,000 a year. Due to paying more than the minimum into my pension, paying for various workplace benefits (such as health insurance) and a share scheme, I receive about £5000 in my pocket. I also receive roughly £10,000 - £15,000 after tax (depending on my companies stock price) every 3 months from shares vesting and I sell them instantly. Traditionally, I have not been very good at saving as much of these share bonuses as I should be, and I typically end up spending 1/3 of them each time on holidays, gadgets or work on our house (for example, we had a new kitchen installed fairly recently).

As well as my main role, I do a small amount of technical consulting, programming and other tech side-hustles on evening and weekends. I will talk about these a lot more in the future. I charge ~£150 an hour for this and have it all setup through a limited company managed by an accountant. I have to pay my accountant £150 a month for this, and I do not draw any money from the company at all except for £2000 a year as a tax-free dividend (which is going to drop to £1000 next tax year). Typically I invoice £2000 a month but this is all retained in the company. I intend to use this to invest into other income streams in the future (you can look forward to a future blog on this).

My partner also earns a good income of ~£2,500 a month. However, we keep our finances pretty separate. We have a joint account setup for bills which we split proportionally based on our salaries. I also cover the majority of major expenses such as holidays, groceries, dinners out etc. However, having her help on the bills is a huge part of what helps me achieve such a good savings rate (don’t worry, she is supportive of our journey to fat FIRE, all my numbers are assuming both of us will retire as the same time. :) )

Savings Rate

Currently I save around £2000 each month. I also save around £10,000 every 3 months from my stocks vesting. Finally, £1560 a month goes into my pension each month, including my employer’s contribution and basic rate tax relief. I have used this site to create the graph’s below.

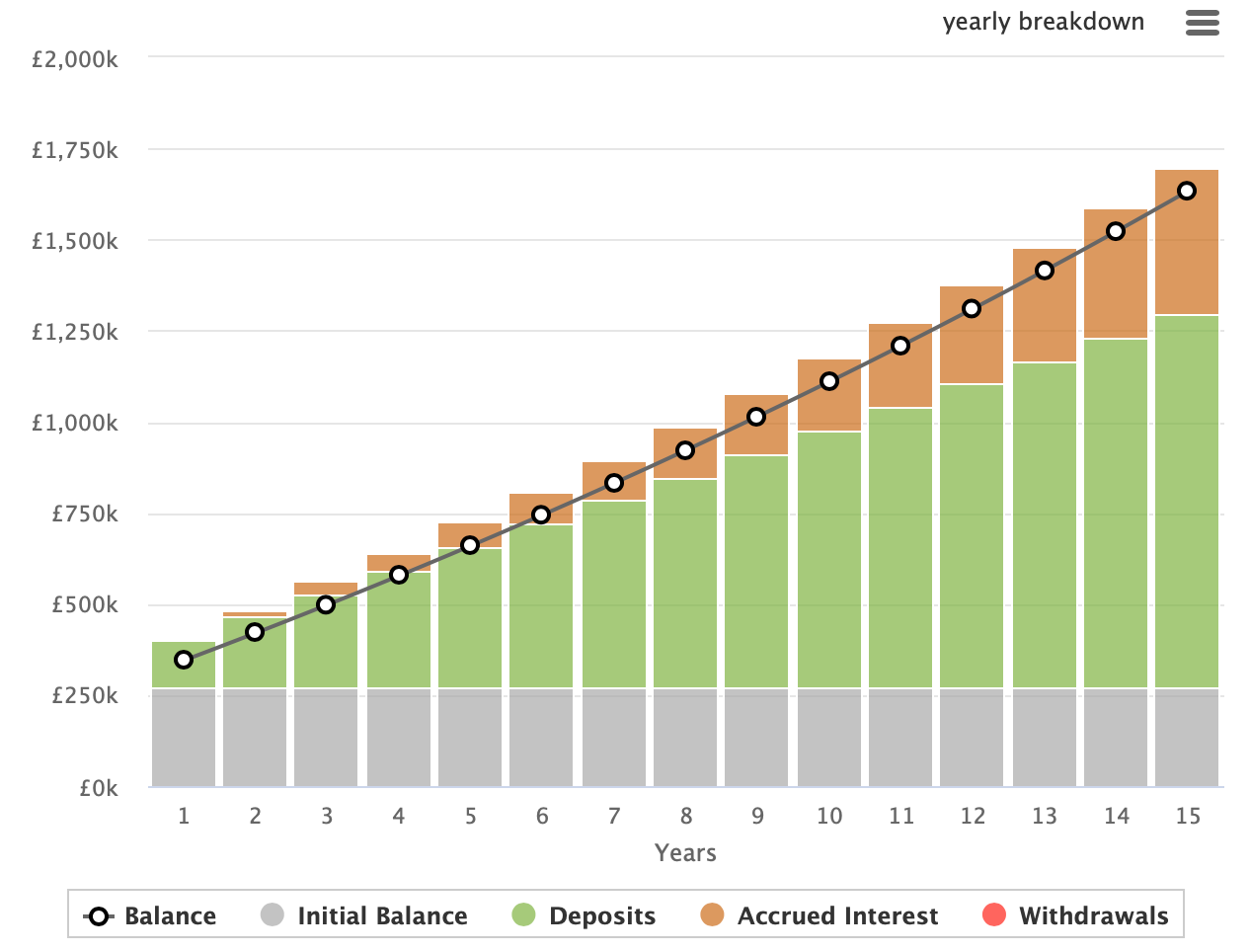

For my Cash, ISA + GIA, if they grow at 3% per year and I contribute ~16k per quarter to them, I end up with ~£1.6million invested:

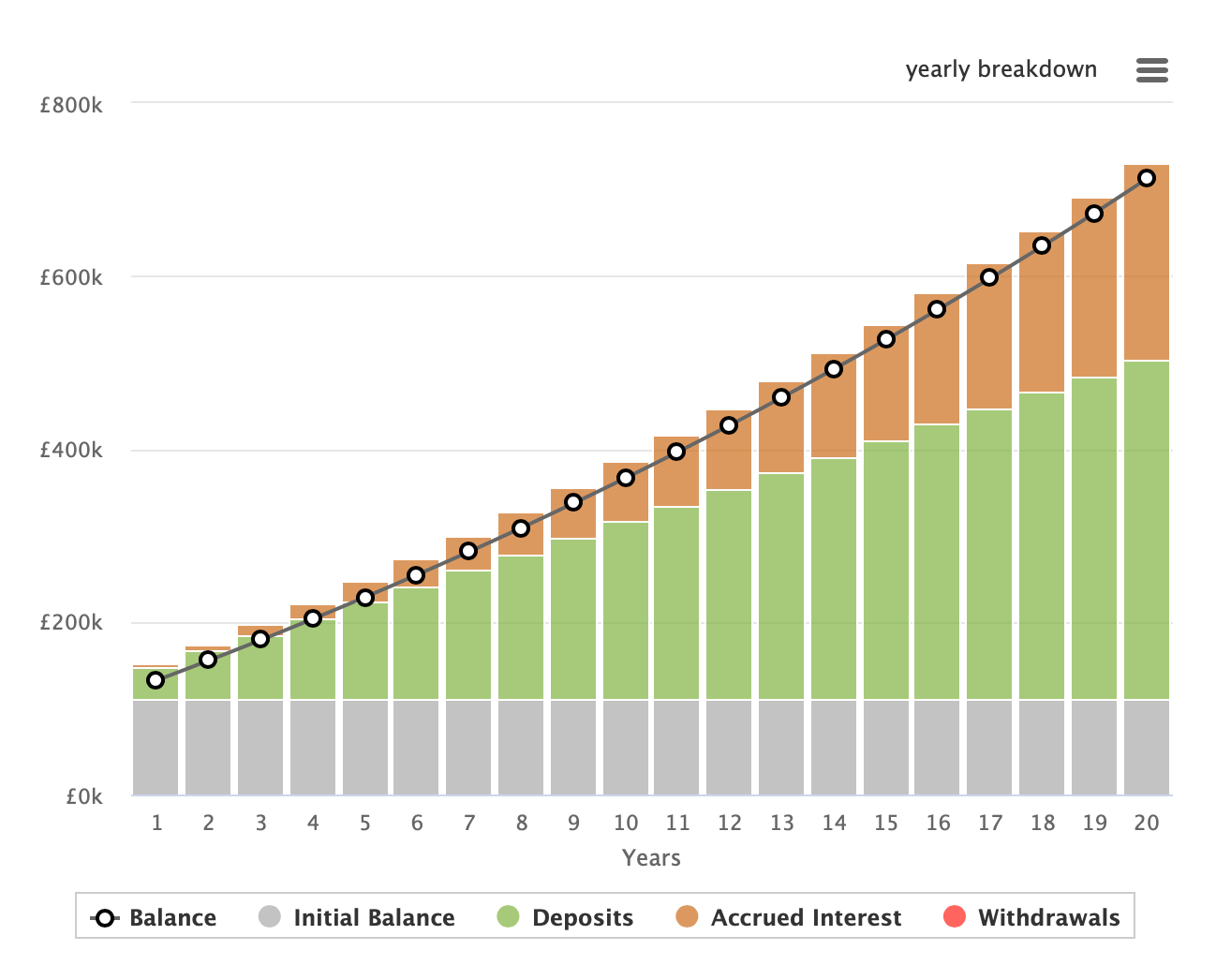

For 20 years, I end up with ~£2.2million invested:

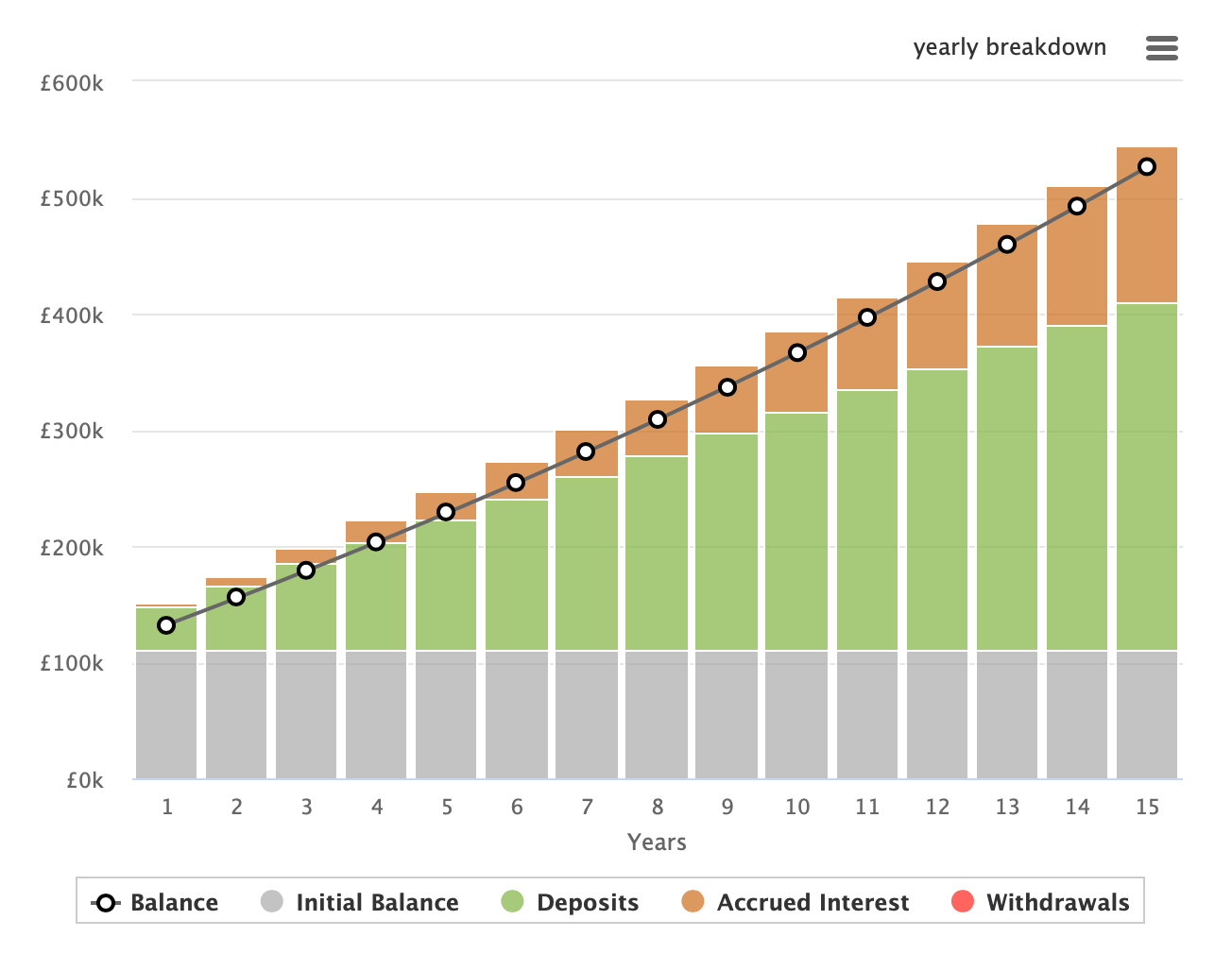

For my pension; if we assume a 3% growth rate and continued contributions for 15 years, my pension looks as follows:

If I push on for 20 years it looks like this:

This means that if I work for 15 more years and everything goes perfectly (which it won’t) then I should have ~£2.2 million invested.

In reality, the composition of the above will be a bit different, since I would invest more into my pension than illustrated above, since it makes sense to use the £40,000 allowance (assuming my income stays under £305k).

What if you use all your cash to buy a bigger house?

If I use all my cash (72k), the situation look as follows:

It still looks pretty good, with ~£1.5 million invested in my ISA. However, this is not the whole story. If we purchase a house in the region of £1,000,000 then the following bills are going to increase too:

Mortgage will increase from ~£1500 per month to ~£3000 per month.

Decreasing term life insurance (usually a requirement of the mortgage) will increase from £13 a month to ~£50 per month.

Gas & electricity bills are likely to increase from around £292 to ~£350

Council tax will increase from £2000 a year to ~£3.2k a year.

We may also need some cash in the short term to decorate. At a a minimum, moving house will increase our spending by ~£2000 a month (at least in the short term. As we pay down the mortgage it should lower substantially).

Moving house could really impact our journey to fat FIRE and if we do decide to move, we need to weigh up if the bigger house will make us genuinely happier, even if it means moving our target retirement date back. There are some things we can do to mitigate this though such as reducing spending (easy) and increasing our earnings (hard).

Other Risks

Having Children

My partner and I are still in discussion about whether we want to have children. The biggest impact this would have on our finances is my partner would stop working, which means I’d need to cover all of our bills and living expenses. This could drastically reduce my savings rate.

Further Lifestyle Creep

This is the big one. It’s very easy to add just one more subscription service to the list and to pay for the upgrade to the hotel room. Do this too often and we’ll find ourselves with a much lower savings rate than we hoped.

Inflation

Inflation has the ability to undo all our savings and to keep moving the target in terms of retiring early. For example, according to this calculator, £10,000 in 1990 is worth £29,080.43. However, that £10,000 invested in 1980 with 3% compound interest is only £26,879.12. If we don’t beat inflation with our savings rate, we will actually be getting poorer relatively speaking.

Changes to the Tax Rules

There is already rules announced which impact savings within a GIA and also drawing down from a company. In the next tax year, the tax-free dividend allowance is dropping from £2000 to £1000, and then the year after down to £500. I have read rumours about reducing the ISA allowance, pension contribution limit and last year we saw an uptick in National Insurance to pay for covid. All of these things would have a huge impact on savings and drawdown plans. There is nothing we can do about this though (except move countries) and its why it’s so important to review your FIRE plan regularly to ensure you have accounted for any changes in tax rules.

Being Laid Off

I am in a very fortunate position in a very fortunate job. This might not last forever and it is well reported that ‘big tech” has been laying off and will likely continue to for the foreseeable. It’s therefore important I keep investing in myself, building side income streams and also ensuring I keep my skills updated so that I am employable by others. Truthfully, of all the risks above being laid off is my biggest fear and the one I spend the most time worrying about.

"being laid is my biggest fear " -- Didn't realise young men would have such fears in the first place:)

Jokes apart , being laid off is a legitimate fear and as you said , as long as you have employable skills , an emergency fund and a huge pool of investments , no debt , then you should be fine.

It was interesting to read about the details of your side hustles. Do you have any advice for a 40 year old software middle manager on creating some side hustles ?

Nice plan! Congratulations!

It seems quite good. However plan well ahead about kids. They are both a major satisfaction, worries and drain of resources. Depending on your location, expectations of studies for them, and side activities, they can cost much more than expected...

Regarding home, it's normally a good average equity, unless some bad luck or poor picking (area, quality of built...). However, with a bit more thought, you can invest in some low cost index funds and get higher return in the long term. Again depending on location, inflation and interest rates. But normally interest rates don't stay high long, and inflation helps index valuations.

There is an Excel calculator to compare those investments for your particular case.

Anyway, thanks for sharing, all the best and you have a new subscriber 😉

Francisco