From a young age I aspired to earn a six figure salary. The number was mostly arbitrary; I grew up poor and it seemed a really big number. I certainly didn’t know of anyone who made this sort of money and in the circles I moved in, £40k seemed to be an aspirational salary that would mean you can live a middle class life.

I was fortunate enough that my first job out of university was £30k. This was more money than my parents made and I genuinely believed I would be sorted for life. However, the job was in London and I failed to understand quite how expensive it was here. In this post I shared the budget I had at the time:

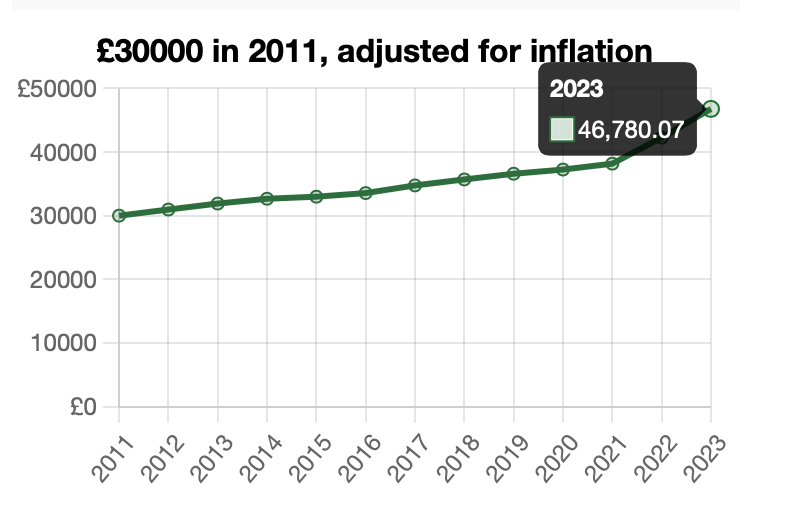

Not too bad right? At the time it certainly seemed so (my rent was in a flat share all inclusive of bills). However, this is where the problem starts. My £30k graduate job was in 2011. According to Glassdoor, the average Technology Consultant Salary in London is now £35k. According to the CPI calculator, the equivalent salary should be ~46k:

Upon entering the work force, highly skilled graduates have much less buying power than I did.

Back to Six Figures…

According to UpTheGains, today only 5% of the UK make >= £100k. This means it is an aspirational salary that most people never achieve. I could not find a data point for how many people made it in 2011, but I would imagine it is roughly the same.

In 2011 when I graduated:

The average house price in London was £416k (source)

The average rent (for an entire flat) in London was £1.2k (source)

The average honeymoon cost 4k (source)

The average wedding cost 19k (source)

The average energy bill was 1.1k for the year (source)

However, today:

The average house price in London is £533k (source)

The average rent (for an entire flat) in London is £2500 (source)

The average honeymoon cost is £3.8k (source)

The average wedding cost remains 19k (source)

The average energy bill is £2.5k (source)

This is interesting. Necessities such as housing and energy have gone up a lot, but luxuries have stayed flat (i.e, they are cheaper in real terms).

None the less, a six figure earner in London can now no longer buy an average house buy themselves, where as in 2011 they could. If you want to live the life of luxury that the previous generation of high earners got to live, you have to aim even higher.

According the the CPI calculator I used previously, 100k in 2011 would be 155k today. According to HMRC, this salary would put you in the top 2% of earner, not far from the top 1%. To have a top 5% lifestyle from 2011, you need to be a top 1% earner.

Stealth Tax

Tax rises are never popular and politicians avoid doing them wherever possible. However, there is a very clever way to raise taxes without causing a stir that has been happening for a while and mostly going under the radar until recently; freeze income tax bands.

Tax bands typically raise with inflation, but they have been frozen since 2022. The Telegraph has a nice little calculator for you to understand the impact this has on your income:

A Glimmer of Hope

Things seem to be turning somewhat of a corner. Interest rates are predicted to drop, energy costs are set to drop in the second half of 2023 and next year is a general election year.

For now, keep working hard, practising your Leetcode (or not).