I recently read a conversation on my company’s Slack where my colleagues were asking for tax advice regarding their vested RSUs. The advice was all over the place and, as far as I know, incorrect.

If you get any of your compensation in RSUs or make a large amount of trades, you need to know what a section 104 pool is. This post is my attempt explain it.

Warning: I am not a finance professional, just a Software Engineer who spends too much time on Google. This is not financial advice and please consult a tax professional for your specific situation (I do!).

What is a Section 104 Pool?

From HMRC’s website:

Shares of the same class in the same company are identical. Suppose you have a holding of 12,000 Wilson and Strickland plc 25 pence ordinary shares acquired at different times for different prices. You then sell 2,000 shares. To calculate the gain you need to know how much cost can be attributed to the shares you’ve sold. The capital gains rules for shares allow you to do this.

From 6 April 2008 all shares of the same class, in the same company, are together called a ‘Section 104 holding’. You add together the costs of the shares in this holding: each share in the holding is treated as if acquired at the same average cost.

At its simplest; shares bought for the same company and held for a period of time are considered as a pool rather than their individual transaction purchase price.

Here is a simple worked example. Let’s say you work for company A and you get a 1000 stock RSU grant that vests on a schedule of 60% after a 1 year cliff and the rest equally over the next 4 years.

Q1,2022: 600 shares, value at time of vesting was £100 per share.

Q2, 2022: 26 shares, value at time of vesting was £50 per share.

Q3, 2022: 26 shares, value at time of vesting was £40 per share.

Q4, 2022: 26 shares, value time of vest was £30 per share.

Your total 104 pool here would be 678 shares, with the pool cost being:

(600 * 100) + (26 * 50) + (26 * 40) + (26 * 30) =

60000 + 1300 + 1040 + 780 =

£61,953.

We can then also work out the average buy price by doing £61953 / 678 (total amount of shares which comes to £93.09.

Therefore, for the purpose of working out gain/loss when you make a sale, you should use the value of £93.09.

As more shares vest, you need to re-evaluate the calculation and that transaction into the equation. There is another worked example here courtesy of HMRC. In their example they also factor dealing costs into the equation. I don’t seem to have any of these, but depending on your company, you may.

Is There any Exceptions?

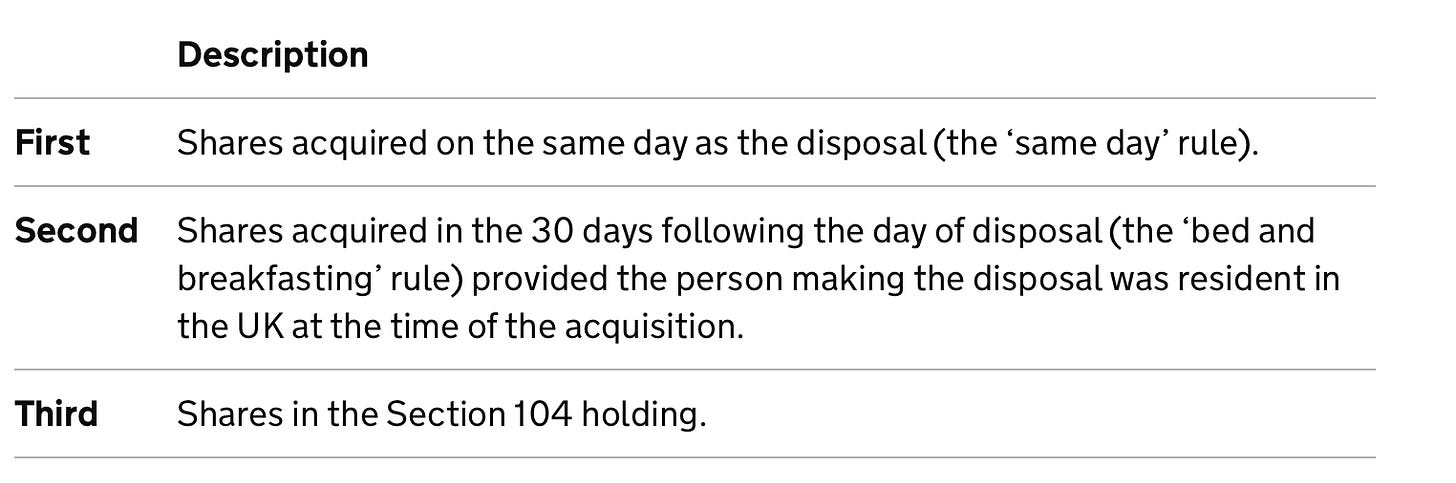

Unfortunately yes, it gets a bit more complicated than this. In the list of how to treat your shares for capital gains purposes, the section 104 pool actually comes at the bottom of the list:

Let’s talk through what this means.

Shares Acquired on the Same day of Disposal

If you buy and sell your companies shares on the same day, then you “match up” that buy and sell transaction for capital gains purposes.

For example, let’s say you have an average pool cost of £35 a share. If you bought 1 share at 9AM for £50 and sold it at 4PM for £55, you would have a capital gain of £5 (£55 - £50).

Bed & Breakfasting (30 Day Matching)

This works the same as “shares acquired on the same day” except with a 30 day window.

For example, let’s say you have an average pool cost of £35 a share. If you bought 1 share on 04/02/23 for £40 and sold 2 shares on the 27/02/23 for £38.

One share would be treated with the 30 day matching rule, one would be matched with the pool. Therefore you’d calculate your capital gain as (£38 - £40) + (£38 - £35) = £1. You’d therefore have a capital gain for this disposal of £1.

Let’s Add More Complexity…

You may have noticed that all my examples up until now use GBP. However, its very likely if you work at a FANG+ company that your shares are issued in USD.

This is where it gets a little more complicated. To work out the cost of your shares, you have to use the exchange rate published by HMRC for a given month, not the one that you actually got for your specific transaction. You can find them here.

Here is a an excerpt including USD for April 2023:

Wrapping Up

Knowing which tax rules to follow is pretty complicated, and in my experience it’s best to just pay an accountant. However, I think the FIRE community is generally curious and wants to know how to do work this stuff out themselves, at least at a high level. Remember that you do get a tax free capital gains allowance of £6000 per year, and you can also declare losses to increase this in future years.

I hope you found this post helpful. Let me know by replying to this email or leaving a comment.

Recommend this tool; http://www.cgtcalculator.com/default.htm

With some pretty minimal excel work you can take your trade history from any major platform and format for the tool.

Very useful if dealing with large numbers of trades.

>exchange rate published by HMRC

Now this I did not know thanks.