A new tax year, a new ISA subscription.

For the last 5 years or so, I simply renew my Stocks and Shares ISA with Vanguard and buy the Global All Cap Acc, drip feeding money in until it’s full. I then do the same thing in a GIA via Freetrade. However, this tax year I opted to open a Cash ISA with Shawbrook. At 3.4% tax free interest, its a pretty good option if you think you might need the money in a time horizon that is less than 5 years.

As mentioned in this post, I am still on the fence about buying a bigger house, and until I have certainty on this, I will be keeping a lot more money in cash than I would have previously.

Why Shawbrook?

I have never used Shawbrook before, but I selected them after looking on MoneySavingExpert. It currently gives the best interest rate and allows you to pick between monthly and annual interest.

So far I have no real issues with Shawbrook and would reccomend them. Transferring in and setting an account up was easy enough. I have not tried to withdraw yet though.

One nice touch so far is they raised their interest rate to make it more competitive automatically. More and more banks seem to be doing this which is nice to see.

Should I Get a Cash ISA This Tax Year?

It depends on your goals and your risk appetite. It’s generally agreed that cash ISAs are better for short term investing and stocks and shares ISAs for longer term investment. This is to account for the fact that in the short term market swings could leave you in the red. For example, you can see the returns on the S&P 500 have varied wildly over the years.

However, the uncomfortable truth is that even with a 3.4% interest rate in my cash ISA, I am still losing buying power every month.

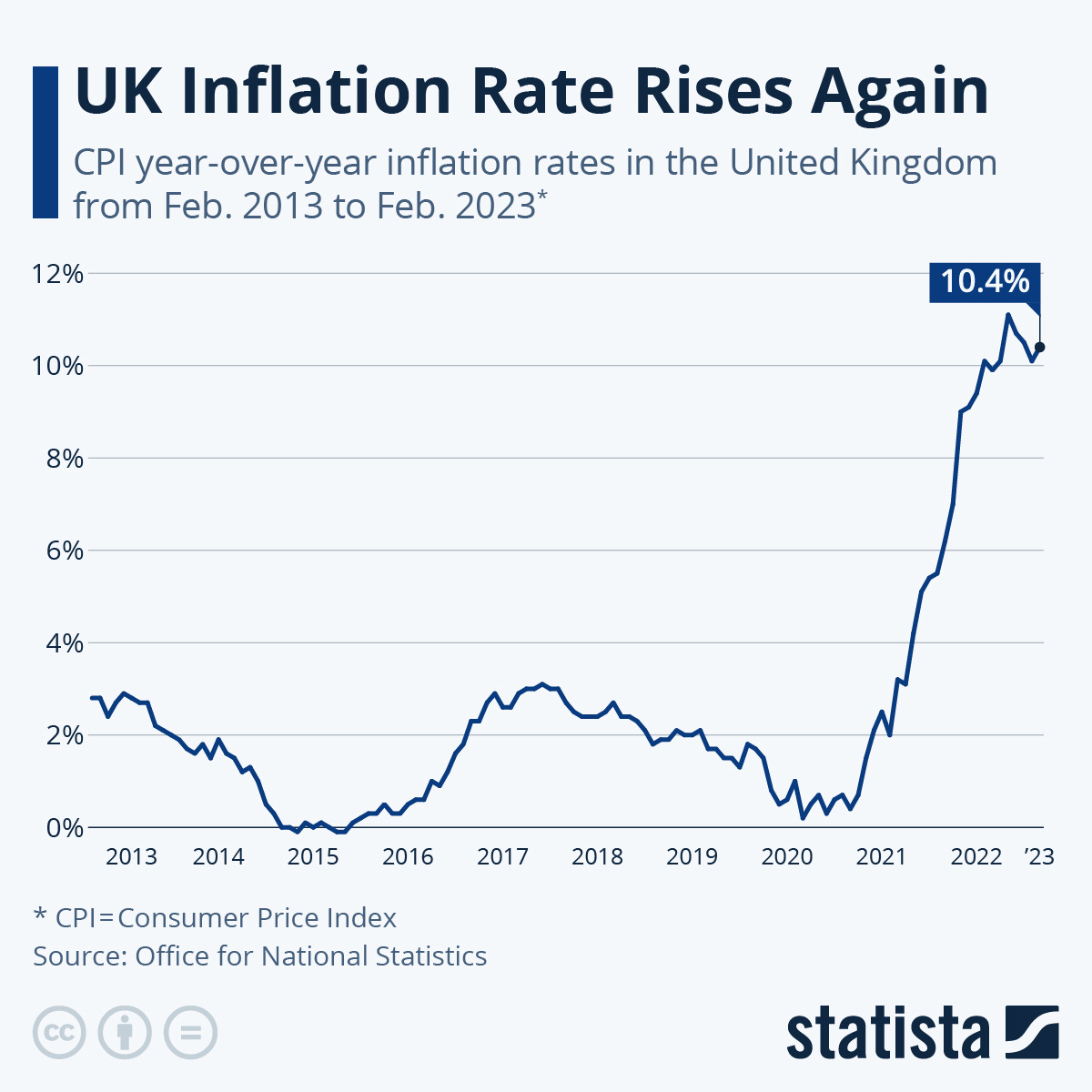

Depending on what measure you use, inflating is currently between 9% and 10.4% in the UK and it is not letting up quickly:

This means that there is a gap of 7% growth in my money, but there are not a lot of better options out there right now.

Final Thoughts

Once my cash ISA is maxed, I’ll also be putting more money into my mortgage than I would have in “good times”. Interest on my mortgage is calculated daily and I just had to move from a 2% fix to a 4.5% fix. As discussed above I cannot beat that 4.5% with any other savings vehicles at the moment, so paying down my mortgage seems an attractive option.

What will you be doing this year due to high inflation? Let me know!

-The Fat Software Engineer

Paying down the mortgage seems the best approach to me, you can beat the interest rate for savings and you're creating a cushion for the future.

> even with a 3.4% interest rate in my cash ISA, I am still losing buying power every month

Yikes inflation is wild right now